Regulation A+ offerings provide emerging businesses with a unique pathway to raise capital from the public. Under provisions of the JOBS Act, companies can offer and sell securities through Regulation A+, which offers a efficient framework for raising up to \$75 million in funding.

WRH+Co acts as a trusted partner for businesses navigating the complexities of a Regulation A+ offering. Our professionals guide companies through every step of the process, from developing the offering documents to marketing the offering to investors.

We believe that Regulation A+ can be a game-changing tool for businesses seeking growth and expansion. Speak with WRH+Co today to learn how we can help your business unlock the potential of a Regulation A+ offering.

A Regulation A+ Offering: Hype or Reality?

The crowdfunding landscape is constantly evolving, and with that comes a wave of new opportunities for both investors and companies. One such avenue gaining visibility is Regulation A+, a securities offering system that allows private companies to raise capital from the wider investor base. But is it all hype, or does Regulation A+ truly offer a legitimate path to funding?

Proponents of Regulation A+ point out its potential to democratize access to investment, allowing smaller companies to attract capital that was previously difficult to access. They argue that it simplifies the fundraising journey and enables entrepreneurs to bring their ideas to life.

On the other hand, critics raise doubts about the feasibility of Regulation A+ in practice. They cite potential obstacles, such as the financial burdens associated with compliance and the intricacies of navigating the regulatory framework.

Outline Title IV Regulation A+ for me | Manhattan Street Capital

Regulation A+ is a funding mechanism under Section IV of the Securities Act of 1933, providing startup businesses with an avenue to raise capital from the public. Manhattan Street Capital is a leading platform specializing in Regulation A+ offerings, helping companies navigate this complex process and connect with investors.

- A framework designed to streamline the capital raising process for private companies.

- Manhattan Street Capital|MSC|ManStreet is a licensed intermediary, providing support to both issuers and investors.

- Their knowledge in Regulation A+ allows them to successfully execute offerings and enhance funding outcomes for their clients.

By outlining key aspects of Regulation A+, Manhattan Street Capital empowers businesses to make informed decisions about their capital needs.

Unlocking Opportunities through Reg A+

A groundbreaking new solution has emerged for companies seeking to attract investment. Reg A+, a recently modernized regulatory framework, provides a powerful alternative to traditional methods. This innovative avenue allows businesses to openly offer their securities to the broad market. Reg A+ offers substantial benefits, including reduced regulatory hurdles.

- Fueling growth

- Connecting businesses and investors

- Robust regulatory oversight

What Is A Reg - We Have All Of ThemAll

We're living in a world that's overflowing with Regs. They dictate everything from how we Engage online to what we can Eat on a daily basis. It can feel like there's a Rule for every little Thing we make. But don't worry, because we've got you covered. We have A plethora of the regs!

Whether you're looking for Information on a specific regulation or just want to Grasp the general landscape, we're here to help. Just Browse through our collection and you'll find what you need.

Delve into Regulation A+ to gain access to Innovative Ventures

Regulation A+, a relatively new securities law, presents a unique avenue for startups to raise capital. It allows companies to sell shares of their company to the public through a streamlined and affordable process.

, Nevertheless, navigating the intricacies of Regulation A+ presents challenges. Startups are required to adhere with specific disclosure requirements and undergo an thorough review process.

In order to facilitate a successful Regulation A+ offering, startups should conduct thorough due diligence, create a robust business plan, and work with experienced legal and financial advisors.

Regulation A+ Works with Equity Crowdfunding

Equity crowdfunding has become a popular way for startups to raise capital. However, there are limitations related to the amount of money that can be raised through traditional equity crowdfunding platforms. This is where Regulation A+ comes in. Regulation A+ allows companies to raise up to $75 million from the public through a variety of channels, including online crowdfunding platforms.

Regulation A+ offers numerous advantages over traditional equity crowdfunding. Firstly, it provides companies with access to a much larger pool of investors. Secondly, Regulation A+ guidelines are more lenient than those for other types of securities offerings. Thirdly, a successful Regulation A+ offering can result in increased visibility for the company.

- Businesses looking to raise capital through Regulation A+ often prefer equity crowdfunding platforms as their primary fundraising channel.

- These platforms provide a streamlined way to reach investors and manage the offering process.

Regulation A+ FundAthena {

FundAthena is a dynamic investment platform that leverages Regulation A+, a regulation allowing companies to raise capital from the public readily. Through this process, FundAthena empowers promising businesses to secure funding in pursuit of growth and development.

- Their approach to Regulation A+ presents participants with a unique opportunity to contribute in promising companies while gaining from the transparency of this regulatory environment.

- Furthermore, FundAthena's experienced professionals works closely with companies throughout the entire process, ensuring a efficient experience for both participants.

With FundAthena's platform, investors can explore a diverse range of investment opportunities and participate actively in shaping the future of promising industries.

A blank check

A blank check represents unrestricted power. It's a powerful representation of trust, allowing the holder to dictate the terms and value. This concept can be applied to financial transactions, giving rise to both risks. However, the true impact of a blank check is contingent upon the motivation behind it.

Antiquated Stock Securities

During the era of pre-revolutionary expansion, many companies sprung up to facilitate trade and progress. These ventures, often chartered by prominent figures, released stock securities as a method to raise capital. Usually these certificates showed a portion of ownership in the company, and could be exchanged among investors, highlighting an early example of market-based economy.

Regulation governing

Regulation is the process of establishing and enforcing rules, guidelines, and standards to manage activities, behaviors, or products within a specific domain. Its objective is to ensure order, safety, fairness, and accountability. Regulatory frameworks can vary widely across industries, jurisdictions, and societal values.

- Regulation is enforced by legislation, policies, permits, inspections, and enforcement actions.

- Regulations offer a range of benefits, including consumer protection, environmental preservation, market stability, and innovation.

- , such as increased costs for businesses, reduced flexibility, and unintended consequences.

The impact of regulation depends on factors like clarity, enforcement mechanisms, public acceptance, and the ability to adapt to changing circumstances.

We Found A Reg

It's official, we finally hit the jackpot on it. After an eternity of searching, the mythical vehicle has been brought to light. Rumors were flying around for years, but now we have proof. This find is going to blow our minds.

- Brace yourselves for the announcement

- Anticipate a tsunami of excitement

- Stay tuned for more details

Fueling Growth Through Title IV Reg A+

Diving into the captivating world of Title IV Reg A+, our latest infographic provides a in-depth exploration of this robust fundraising mechanism. Discover how Reg A+ can empower companies to raise capital from the everyday individual. This interactive guide delves into key elements of Reg A+, including eligibility standards, registration process, and the advantages it offers for both businesses and investors.

- Uncover the nuances of Title IV Reg A+

- Acquire insights into the filing process

- Comprehend how Reg A+ can catalyze your fundraising efforts

Reg A+ Financing - Securex Filings LLC

Securex Filings LLC offers comprehensive assistance for companies seeking capital via Regulation A+ offerings. We team of experienced professionals assists clients through the detailed process, from preliminary application to smooth closing. Securex Filings LLC focuses in accelerating the Reg A+ procedure, ensuring compliance with all applicable rules.

Our team in addition extend consistent consultation services to help companies address the difficulties of a registered offering. Considering you are a startup, Securex Filings LLC serves as your reliable collaborator for a achievable Regulation A+ offering.

Invest in Ideas

crowdfund.co is a dynamic platform/site/hub dedicated to connecting individuals/entrepreneurs/projects with potential backers/investors/supporters. On this user-friendly/intuitive/accessible site/marketplace, you can discover/browse/find a diverse range of funding campaigns/projects/initiatives spanning various industries/creative fields/innovative ideas. Whether you're an aspiring entrepreneur/passionate innovator/dedicated creator seeking to launch your project/bring your vision to life/fund your endeavor, or a socially conscious investor/impact-driven backer/community supporter looking to make a difference/contribute to something meaningful/support the next big thing, crowdfund.co provides a robust/comprehensive/engaging space/environment/ecosystem to connect and collaborate.

Fundrise Reg A+ Offering

Fundrise currently launched a Reg A offering. This program allows people to invest in shares of Fundrise's fund at adiscounted price. Fundrise is aiming for capital through this offering, which will be used to expand its assets.

- Fundrise's Reg A+ offering is a unique opportunity for everyday people to invest in the real estate market.

- {However|That said, it is important to conduct thorough research

- Entry point for this offering is accessible.

The Securities and Exchange Commission

The SEC is an independent agency of the United States government. Its primary mission is to protect investors, maintain fair and equitable markets, and facilitate capital formation. The SEC achieves its goals by regulating federal securities laws and by providing investors with essential information about the securities markets.

It has broad authority to investigate and prosecute fraudulent activities in the securities market, including insider trading, market manipulation, and securities fraud. The SEC also determines rules and regulations for companies that issue securities and for exchanges where securities are traded. ,In addition, the SEC provides investor education and outreach programs to help individuals understand the risks and rewards of investing in the securities markets.

Crowdfunding Expert Title IV Reg A+ Equity Crowdfunding

Title IV Reg A+ equity crowdfunding offers a compelling avenue for companies seeking to raise capital from the public. This innovative method allows businesses to harness the power of crowdsourcing to secure funding, often at more competitive terms than traditional financing options. Nevertheless, navigating the complexities of Reg A+ can be difficult. That's where CrowdExpert comes in, providing expert guidance and assistance to help companies effectively complete their Title IV Reg A+ equity crowdfunding campaign.

- CrowdExpert provides a comprehensive suite of tools designed to streamline the entire crowdfunding process.

- Seasoned professionals work with companies to develop compelling marketing materials.

- The platform offers comprehensive compliance assistance to ensure adherence to all regulatory requirements.

By partnering with CrowdExpert, companies can maximize their chances of a successful Reg A+ equity crowdfunding campaign, unlocking access to capital and propelling their growth forward.

Evaluating the Waters

Before diving headfirst into a new venture, it's always wise to gauge the waters first. This involves carefully exploring the market and identifying potential hurdles. By gathering valuable data, you can formulate a more informed decision about whether to venture on your journey.

Crowdfunding for Masses

Crowdfunding has transformed into a powerful tool for individuals and organizations to raise funds from a large pool of contributors. This movement has made it possible for people to fund projects that might have otherwise been unfeasible.

One of the central benefits of crowdfunding is its ability to foster access to capital. Individuals can now bypass traditional lending institutions and connect directly with potential investors.

This straightforward connection between creators and their audience cultivates a sense of community and accountability that is often lacking in more conventional funding models.

Additionally, crowdfunding platforms provide a extensive set of tools and features to help creators prosper. From marketing strategies to campaign administration, these platforms offer guidance at every stage of the crowdfunding journey.

Platform StreetShares

StreetShares is a lending platform that provides small loans. It matches lenders with entrepreneurs in need of capital. StreetShares highlights military-owned companies. Their mission is to support the growth and success of these enterprises by providing accessible capital.

- StreetShare's digital loan process is intended to be easy

- Borrowers can request funding online

- StreetShares work with entrepreneurs to determine the best financing options

Securing Funding Through Regulation A+

Regulation A+ has emerged as a powerful vehicle for companies seeking to raise capital in the public market. This level of fundraising offers an attractive option for businesses aiming to generate substantial investments, while providing investors with a clear avenue. By adhering to the framework established by the Securities and Exchange Commission (SEC), companies can efficiently exploit Regulation A+ to accelerate their growth goals.

Several factors contribute to the prosperity of Regulation A+ fundraising. Initially, it allows companies to raise capital from a broader investor base compared to traditional private funding rounds. Furthermore, the streamlined procedure and relatively lower expenses associated with Regulation A+ make it an desirable choice for companies of various sizes. Finally, the enhanced visibility that comes with going public through Regulation A+ can significantly boost a company's standing.

- Take note of some key approaches for successful Regulation A+ fundraising:

- Formulating a compelling pitch that resonates with investors

- Creating a strong team with relevant experience and expertise

- Obtaining robust financial projections and due diligence

- Connecting with potential investors through targeted outreach efforts

- Maintaining clarity throughout the fundraising process

By carefully implementing these tactics, companies can maximize their chances of a successful Regulation A+ fundraising campaign.

SEC EquityNet

The Securities and Exchange Commission EquityNet platform provides a robust framework for businesses to connect. It offers a suite of tools designed to facilitate the process of raising capital through equity. Through EquityNet, startups and established businesses can connect with potential funding sources. Moreover, the platform maintains strict regulatory standards within the equity crowdfunding space.

- Essential components of EquityNet include:

- Robust investor matching systems

- Deal flow management

- Regulatory guidance and compliance support

Regulation A+ Offerings

Regulation A+, often referred to as Reg A+, is a regulatory framework that allows companies to seek investment from the public in a streamlined manner. Unlike traditional initial public offerings (IPOs), Reg A+ offerings enable companies to market securities to a wider range of investors, including average investors, without the extensive requirements and costs associated with a full-scale IPO.

- Under Reg A+, companies can raise up to \$2 million in a 12-month period.

- The offering process is regulated by the Securities and Exchange Commission (SEC).

- Reg A+ offerings provide companies with an viable path to capital that can facilitate development.

Regulation A+ at Investopedia

Regulation A+ is a financing/fundraising/capital-raising mechanism under the U.S. Securities Act of 1933 that allows companies to raise capital/funds/equity from the public. It offers a streamlined/simplified/flexible path for businesses to attract/secure/obtain investments, compared to traditional initial public offerings (IPOs).

Investopedia provides comprehensive/in-depth/extensive information about Regulation A+, including its history/origins/background, requirements/guidelines/parameters, and advantages/benefits/pros for both companies seeking funding/investment/capital and individual investors. Their resources/articles/content cover various aspects, such as the process/steps/procedure involved, eligible companies/entities/businesses, and potential/possible/likely risks associated with this type of investment.

Investors/Companies/Individuals can rely on Investopedia's trusted/reliable/credible platform to gain a solid/firm/strong understanding of Regulation A+ and make informed/educated/wise decisions about potential investments.

Regulate A+ Companies

A+ companies often operate within strict industry norms. However, there is an ongoing controversy about the importance for further regulation. Some proponents argue that increased attention is needed to ensure fairness and accountability in the market. Others believe that A+ companies are already appropriately regulated and that additional laws could hinder innovation.

Regulation A+ Summary

A comprehensive understanding of rulemaking is essential for individuals operating within a fluid market landscape. This regulation serves to ensure fair competition, protect consumers, and foster sustainable economic growth. A+ summaries provide a concise outline of key ideals within a specific regulatory domain, underscoring its influence on various stakeholders.

- Key features

- Examples

- Advantages

- Obstacles

Governance + Real Estate

The intersection of regulation and real estate presents a dynamic landscape, demanding transparency from all stakeholders. Buyers must navigate a complex web of laws, while developers face stringent requirements. Effective enforcement is crucial for ensuring fair market practices, protecting consumer rights, and supporting long-term growth within the real estate sector.

Our Company's IPO First JOBS Act Company Goes Public Via Reg A+ on OTCQX

We are thrilled humbled to reveal that our company, a pioneering example of the JOBS Act's impact, is now publicly traded via Regulation A+ on the OTCQX marketplace! This landmark event represents years of hard work and dedication through our talented team. We are excited to begin this new chapter with a publicly listed company, opening doors to expanded opportunities for growth, innovation, and shareholder value.

Our Reg A+ offering secured capital from accredited investors, demonstrating the strong confidence in our vision and the potential of our business. We are thankful to our investors for their belief in us and we look forward to sharing our successes with them. This listing on OTCQX extends increased visibility for our company, allowing us to connect through a wider range of investors and stakeholders.

- Follow our journey as we continue to grow our business and create value for our shareholders.

FundersClub Crowd-Funded Reg A+ Offerings

FundersClub, a leading equity crowdfunding platform, has announced the launch of its new feature allowing companies to conduct Regulation A+ fundraising campaigns directly on its platform. This move enables businesses to tap into the growing pool of accredited and non-accredited investors seeking alternative investment opportunities. Via Reg A+, companies can raise up to one hundred million dollars from the public, providing a valuable opportunity for growth capital.

- Through FundersClub's robust platform, companies can seamlessly launch their Reg A+ offerings and connect with a wider investor base.

- It, FundersClub further solidifies its position as a leader in the equity crowdfunding space, presenting innovative solutions for both companies and investors.

Theinitiative's launch of Reg A+ fundraising is expected to significantly impact the equity crowdfunding landscape, stimulating new opportunities for growth and innovation.

Securities Regulation What is Reg A+ Regulation A+ Crowdfunding Platforms

Regulation A+, often referred to Reg A+, is a tier of securities regulation in the United States that provides a avenue for companies to raise capital from the public. It offers a streamlined process compared to traditional initial public offerings (IPOs), making it suitable for smaller businesses.

Crowdfunding platforms have emerged as a popular means for companies to utilize Reg A+ capitalization. These platforms act as intermediaries, connecting companies with potential contributors. Investors can participate in these initiatives and purchase shares of the company in exchange for their contribution.

{Regulation A+ crowdfunding platforms provide various perks to both companies and investors. Companies can raise significant sums without the extensive costs and obstacles associated with a traditional IPO. Investors, on the other hand, have an possibility to invest in promising companies at an early stage, potentially realizing significant profits.

The popularity of Reg A+ crowdfunding platforms has altered the landscape of small business capitalization, providing a more accessible path to capital for entrepreneurs and growth-stage companies.

Tackling Regulation in A+ IPOs

A successful Initial Public Offering (IPO) necessitates meticulous planning and execution, especially when it comes to navigating the complex world of compliance frameworks. For companies seeking an A+ IPO rating, which signifies top-tier financial performance and corporate governance, stricter regulatory scrutiny is inevitable.

This necessitates a comprehensive understanding of pertinent regulations, combined with robust internal controls and transparent communication with regulators. Successfully adhering to these regulatory requirements not only ensures a smooth IPO process but also builds investor assurance.

Supervision A+ Offerings

A+ offerings frequently navigate a complex regulatory landscape. Regulators assess these offerings to guarantee they are in compliance with applicable laws. This requires a thorough understanding of the system governing A+ offerings and a commitment to transparency. Parties must partner closely with regulators to minimize risk and promote assurance in the market. A+ offerings that demonstrate a robust regulatory framework are better positioned for success.

Regulation A+

Regulation A+, also known as Reg A+, is a federal securities rule that allows startup businesses to attract funding from the public. It provides a easier process for distributing securities, relative to traditional methods like an IPO. Regulation A+ is often considered a attractive alternative for companies pursuing growth.

- Key features of Regulation A+ include a tiered framework, allowing companies to attract capital up to defined thresholds. Federal authorities review and approve offerings under Regulation A+ before they can be made to the public.

- Regulation A+ grants companies several benefits, such as reduced regulatory burden and broader potential investor base.

Nevertheless, it is essential for companies to carefully assess the suitability of Regulation A+ based on their unique requirements. It is advisable to seek guidance from experienced professionals to ensure a successful offering process.

Provision Requirements

When presenting an proposal, it's crucial to adhere to all relevant guidelines. These requirements ensure equity and protect both the submitter and the authority. Omission to meet these standards can result in disqualification of the application. It is essential for applicants to thoroughly review and comprehend all applicable policies before presenting their applications.

The Regulation of Crowdfunding

Navigating the intricacies of regulatory frameworks for crowdfunding can be a daunting task for both businesses launching campaigns. Regulations aim to strike a balance by establishing guidelines that promote transparency.{ This can involve measures to prevent fraud and abuse. It's essential for investors to remain compliant these evolving regulations to maintain a safe and transparent environment.

ShareSlide

SlideShare is a leading online site that allows users to share presentations, documents, and tutorials in various styles. It's become a go-to center for students to find valuable content and connect with others in their fields. With its easy interface, SlideShare makes it straightforward to search a wide range of topics. From technology to education, there's something for everyone on this evolving platform.

Regulation A Securities Act of 1933 Jobs Act Article 106 Reg A Tier 2 Offering

The Securities Act of 1933, commonly known as the "33 Act", is a foundational piece of legislation governing securities offerings in the United States. Within this framework, the Jobs Act of 2012 introduced several amendments, including Section 105 which revised and expanded Regulation A+, providing companies with an alternative path for raising capital. Specifically, Reg A Tier 2 offers a flexible avenue for businesses to secure funding through public offerings, potentially reaching larger pools of investors.

This tier allows companies to raise up to twenty million dollars in a twelve-month period, subject to certain regulatory requirements and investor protections. Unlike traditional IPOs, Reg A Tier 2 offerings offer a streamlined process, potentially making it more accessible for smaller businesses. However, companies utilizing this pathway must still adhere to disclosure obligations and comply various regulatory standards.

- Benefits of Reg A Tier 2 offerings include potentially lower costs compared to traditional IPOs, faster fundraising timelines, and the ability to raise capital from a broader investor base.

- Considerations may include navigating the regulatory framework, ensuring compliance with disclosure requirements, and effectively marketing the offering to potential investors.

Govern a Text Concisely

When trying to control a text, it's crucial to maintain transparency. The aim is to provide that the text complies to established guidelines without compromising its primary message. This can involve modifying the style to conform with regulatory standards, while preserving the original voice.

Launching A+ Regulation

The landscape of market rules is in a perpetual state of development. To succeed in this complex realm, it's essential to understand and adhere to the latest legal frameworks. A+ offerings are designed to help organizations achieve this goal by delivering a comprehensive suite of services that simplify the audit process.

- Instances include:

- Qualified guidance

- Setup of regulatory systems

- Development programs on relevant regulations

Legislation A Plus Guarantees

When we speak of "Regulation A Plus," we're referring to a structure that goes beyond the standard. It's about implementing rules in a way that is not only effective but also positive for all stakeholders involved. This means striving for a harmony between protection and growth.

- Advanced Governance

- Fosters Development

- Builds Trust

Rule A vs Regulation D

When it comes to raising capital, businesses often face a crossroads between Reg A and Regulation D. Both of these rules offer distinct pathways for companies to secure funding from investors. Regulation A, also known as a mini-IPO, is designed to make it more accessible for smaller businesses to go public and raise capital. It involves filing a prospectus with the Securities and Exchange Commission (SEC) and offering securities to a broader group. On the other hand, Regulation D, often referred to as private placements, allows companies to raise capital from a limited number of accredited investors. These investors are typically high-net-worth individuals or institutions with significant financial experience. Both provide unique advantages and drawbacks, so the choice between them depends on factors such as the company's size, funding needs, and investor base.

The FRB Regulation A Framework

FRB Regulation A is a comprehensive set of rules and regulations governing the operations of federal banks. It is designed to ensure the safety and soundness of these institutions, protect depositors' funds , and maintain the integrity of the financial system. The regulation covers a broad range of activities , including capital requirements, risk management, lending practices, and consumer protection . Adhering to FRB Regulation A is essential for banks in order to function

Privacy Officer

A Data Protection Officer (DPO) is a designated expert responsible for the implementation of data protection. They ensure that an organization meets relevant data protection laws and policies. A DPO acts as a resource for all parties involved in data processing.

- Their role involves

- identifying vulnerabilities related to data protection

- training staff on data protection best practices

- monitoring data processing activities

Upholds the Adoption of New “Reg A+” Rules for Crowdfunding

In a major/significant/groundbreaking development for the crowdfunding industry/sector/landscape, the Securities and Exchange Commission (SEC) has approved/finalized/ratified new rules under Regulation A+, paving the way/opening doors/creating opportunities for companies to raise capital/funding/investments from a wider pool of investors. These revised/updated/amended regulations are designed to streamline/simplify/enhance the crowdfunding process, making it more accessible/easier to navigate/less burdensome for both businesses seeking financing/investment/funds and individual investors looking to participate/contribute/engage in early-stage companies.

With these changes/modifications/adjustments, Reg A+ is expected to experience/witness/facilitate a substantial/noticeable/meaningful increase in crowdfunding activity, potentially/possibly/likely bringing fresh capital/new investment streams/increased funding opportunities to a diverse range/broader spectrum/wider selection of companies across various sectors/industries/fields.

Reg A+ vs Regulation D

When comparing Reg A+ and Rule 506, it's essential to understand their distinct purposes . Regulation A+ is a fundraising mechanism that allows companies to seek investments from the mass market . In contrast, Regulation D focuses on private placements, enabling companies to offer securities to a specific set of investors who are typically accredited or qualified .

Regulation A+ is known for its greater public accessibility , as it necessitates filings with the federal regulators. This fosters investor assurance. Regulation D, on the other hand, offers more freedom in structuring deals , making it appealing for companies seeking a less regulated process.

- Rule 257 is ideal for companies aiming for broader market visibility.

- Rule 506 suits companies that prefer a more exclusive fundraising .

Understanding the Difference Between Reg A and Reg D Capital Raises

When it comes to raising capital for your check here business, there are various methods available. Two common options are Regulation A (Reg A) and Regulation D (Reg D). While both provide avenues for companies to secure funding from investors, they differ significantly in terms of their conditions and the types of investors they attract. Reg A is a public offering that allows companies to raise up to $75 million from the general public. This means that anyone can invest, providing greater accessibility but also higher regulatory scrutiny. Conversely, Reg D is a private placement limited to accredited investors who meet specific financial criteria. This offers a more targeted approach, potentially attracting larger investments and reducing regulatory burden.

- Furthermore, Reg A requires companies to file a comprehensive registration statement with the Securities and Exchange Commission (SEC), while Reg D has less stringent filing duties.

- As a result, choosing between Reg A and Reg D depends on factors such as the amount of capital needed, the target investor base, and the company's willingness to undergo SEC assessment.

Subsection 506 of Regulation D

Regulation D of the Securities Act of 1933, defines exemptions from the registration requirements for securities offerings. Rule 506 particularly addresses private placements of securities to accredited investors and non-accredited investors. It allows companies to raise capital without going through a traditional public registration. There are two main provisions within Rule 506: Rule 506(b), which relates to offerings made solely to accredited investors, and Section 506(c), which permits offerings to both accredited and non-accredited investors under certain limitations.

To be eligible for Rule 506, companies must follow with a number of rules, including restricting the number of non-accredited investors and revealing certain data about the offering. Rule 506 provides companies with a valuable mechanism for raising capital in a private context, allowing them to secure funding without the rigors of a public offering.

Part 506C Rules

The particular requirements outlined in Section 506C govern the complexities of regulatory compliance. Organizations engaged in designated operations must meticulously adhere to these guidelines. Non-compliance to comply with these requirements can result in penalties, including monetary penalties. A comprehensive grasp of Section 506C is therefore indispensable for individuals engaged in these procedures.

This 506D Conundrum

There is something of a significant portion of fascination surrounding the concept of 506D. It's said to be an unique occurrence. Some analysts claim that it holds the key to some unsolved puzzles. Others remain skeptical, stressing the lack of concrete data.

- Considering your stance on 506D, there's no doubt that it remains to engage the minds of many.

Understanding Regulation D's Rule 506(b) and Rule 506(c)

Regulation D is a crucial aspect of securities law, offering exemptions for private placements under the Securities Act of ’33. Within Regulation D, Rules 506(b) and 506(c) provide distinct pathways for issuers to raise capital privately. Rule 506(b), often referred to as a "general solicitation," permits issuers to sell securities to an unrestricted number of accredited investors, but it imposes restrictions on general solicitation. Conversely, Rule 506(c) enables for general solicitations, but this requires a specific verification process to confirm the accredited investor status of all participants. Opting the appropriate rule depends on the issuer's situation, and careful consideration is essential to ensure compliance with securities regulations.

- The primary variations between Rule 506(b) and Rule 506(c) consist of the extent of general solicitation allowed, verification requirements for investors, and limitations on the number of non-accredited investors.

- Issuers should carefully evaluate both 506(b) and 506(c) before making a decision.

Series 7 Regulations Cheat Sheet

Successfully navigating the challenges of the Series 7 regulations can be a daunting task. This cheat sheet provides a concise overview of key principles to help you master your Series 7 certification .

- Study yourself with the diverse types of securities

- Comprehend the roles and responsibilities of a registered representative

- Analyze common investment strategies

Remain up to par with the latest market trends .

Understanding Regulation A+ Guidance| DreamFunded

DreamFunded offers a wealth of knowledge to help companies understand and harness the potential of Regulation A+. Our comprehensive collection includes articles on key aspects of Regulation A+, such as submission, adherence, and {investor|funding|capital] relations.

If you are a new business evaluating a Regulation A+ fundraise or an existing business seeking to scale, DreamFunded's tools can support you every step of the way.

Over-the-Counter (OTC) Exchanges

OTC Exchanges provide a venue for trading securities that are not listed on regulated stock exchanges. These markets offer investors an opportunity to access in a wider range of securities, often including small-cap companies that may not meet the listing requirements of established exchanges.

Trading on OTC markets can be higher risk than trading on major exchanges, involving a higher level of due diligence from participants. However, the volume on these exchanges can vary widely depending on the demand surrounding specific securities.

Tripoint FINRA Jumpstart Our Business Startups Jobs Act

The Tripoint Jobs Act presents a unique opportunity for startups to secure funding. This legislation intends to promote job creation by reducing the regulatory burden on small enterprises. The Jumpstart Our Business Startups Jobs Act provides a platform for capitalists to contribute in the growth of disruptive companies, propelling progress across diverse sectors.

Securing Tycon SEC Approval Through Qualification

The regulatory landscape for financial technology companies is constantly evolving. Securing approval from the Securities and Exchange Commission (SEC) is a crucial step for any company operating in this space. The process can be complex and time-consuming, requiring thorough documentation and adherence to stringent regulations. These platforms must demonstrate their commitment to investor protection, market integrity, and regulatory compliance. Completing SEC approval signifies a company's credibility and legitimacy in the financial markets, enhancing its potential to raise capital and grow.

Website for Collecting Funds

GoFundMe is a popular online platform that enables individuals to Launch fundraising Efforts. Users can Submit their stories and Request donations from friends, family, and the wider Network. The funds raised are typically used to Assist with various Needs, such as medical bills, education costs, or disaster relief. GoFundMe has become a valuable Option for people facing financial Difficulties.

Over the years, GoFundMe has Experienced countless stories of generosity and support. Countless of individuals have used the platform to Collect funds for their Reasons, often achieving remarkable Results.

Kickstarter Indiegogo Equity Investment

Navigating the world of venture capital can be a complex process, especially for budding entrepreneurs seeking to launch their innovative ideas. Platforms like Kickstarter and Indiegogo, known primarily for their donation campaigns, are increasingly offering share-based financing. This shift presents a unique opportunity for entrepreneurs to raise funds in a way that connects them directly with their customers.

- Businesses can offer

- a percentage of ownership

- {Potentially providing a more direct link between entrepreneurs and theirfunders

However, navigating the intricacies of equity crowdfunding requires careful consideration . Entrepreneurs must be prepared to clearly articulate their vision. They also need to meet legal obligations, which can vary depending on the jurisdiction.

EquityNet Venture Goldman Sachs Merrill Lynch

EquityNet's innovative platform connects entrepreneurs with a vast network of funders, including prominent venture capitalists such as Goldman Sachs and Merrill Lynch. Through its comprehensive due diligence processes, EquityNet ensures that opportunities are carefully vetted, providing security to both funders and companies seeking funding. This strategic partnership with leading market makers further strengthens EquityNet's position as a top-tier platform for growth equity.

Crowdfunding

When enterprises need investment to launch or grow, they often turn to crowdfunding platforms. Crowdfunded projects can range from innovative product development to social projects. A popular method for raising capital through crowdfunding is Regulation A+, also known as Reg A+. This regulation allows corporations to offer their securities to the public, with specific limitations. Reg A+ can be a powerful tool for obtaining funding from a wide pool of investors, while still adhering to industry standards.

Some key characteristics of Reg A+ include: the ability to raise up to substantial capital; a application procedure with the Securities and Exchange Commission (SEC); and investor safeguards. By utilizing Reg A+, companies can tap into the power of the crowd while ensuring compliance with regulatory frameworks.

Capital Raising

The world of finance is constantly evolving, with new avenues for Businesses to Secure Funding. From traditional Venture Capital firms to P2P Lending, entrepreneurs now have a plethora of options at their disposal.

RocketHub and EquityNet are just a few examples of platforms that have emerged to connect Financiers with promising Early-Stage Ventures. These platforms offer various Financial Structures, including Convertible Debt, allowing Accredited Investors to participate in the growth of innovative Companies.

The JOBS Act has also played a significant role in democratizing access to Funding Sources by easing restrictions on Equity Offerings. Emerging Enterprises can now leverage platforms like Crowdfund.co to connect with a wider pool of potential Investors.

The future of Capital Raising is undoubtedly a dynamic and evolving landscape, driven by technology, regulatory changes, and the growing demand for alternative investment strategies. From traditional methods like Stock Market Listings to innovative Community Investing, entrepreneurs have an unprecedented array of tools at their disposal to Raise Capital.

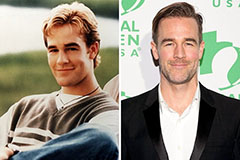

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!